As an employer, you are responsible for the actions of employees who operate their personal vehicles in the course and scope of employment.

- As an employer you can be sued for the actions of your employees operating their personal vehicles for work-related duties.

- As an employer you need to exercise due diligence regarding the driving history of your employees.

Hired Auto Coverage – Applies only to autos that the insured leases, hires, rents or borrows. Coverage is for bodily injury or property damage arising out of the maintenance or use of a hired auto.

Non-Owned Auto Coverage – Applies only to autos used by you or your employees or volunteer workers in the course of your business operations.

Some Examples of Personal Vehicle Use

- Driving personal vehicle between patient appointments

- Driving patients or clients by personal vehicle to and from appointments

- Driving personal vehicle to and from errands for the patient

Driving personal vehicle to and/or from work or first and last appointment is usually considered to be outside the course of employment, but the specifics of each situation will determine coverage.

Driving Statistics from OSHA

Motor vehicle accidents cost employers as much as $60 Billion a year.

When a worker has an on-the-job motor vehicle accident that results in an injury, the cost to the employer averages $74,000. If a fatality is involved that number goes as high a $500,000.

Work related Motor vehicle accidents are the leading cause of employee fatalities in the US.

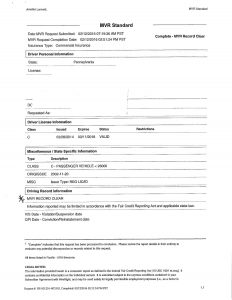

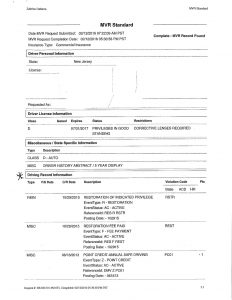

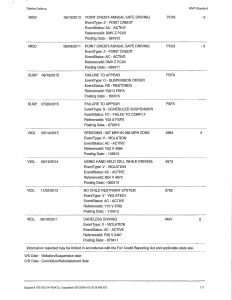

Pre-hire Driving Record Screening

MVR’S (Motor Vehicle Drive Records) should be run on all new hires during the hiring process

- MVR’S should also be run annually –

We recommend at insurance renewal

- MVR’s should be run at time of hire

Motor vehicle reports show the driving record for the individual for the last three years of driving.

Information needed to run a report:

- Date of Birth

- Driver’s License Number and State License

Note: If the applicant/employee has lived for less than three years in the same State, employer should obtain previous address(es) and report from relevant State(s).

Sample Claim Scenario

In the event of a claim, what insurance will apply?

Caregiver gets into an accident while driving between patients’ homes. The accident involves rear ending another car at a stop light:

Injuries – Our caregiver has a broken wrist. The other driver and her child are rushed to the hospital with injuries.

What insurance would apply?

The injured caregiver’s injuries will be paid for by Workers Compensation Insurance.

- The damages to the other vehicle and the injuries to its occupants will be covered by the caregiver’s Personal Auto Policy up to the Limits of Liability for Bodily Injury and the Limits of Liability for Property Damage Per Person and Per Accident. If the limits are not high enough the Underinsured Insurance limit on the other party’s auto policy will be triggered to pay the difference, once a release is signed. If the occupants of the other car hire an attorney, he or she will investigate the claim and during the discovery phase inquire where the caregiver was going at the time of the accident.

- This is when the hired and Non-owned auto claim will begin.

- The attorney will send a letter to the employer of the caregiver to send to your insurance company.

Sample Two

In the event of a claim, what insurance will apply?

Caregiver is driving the patient to a doctor’s appointment and the caregiver loses control of the car and hits a guard rail. There are no injuries to our caregiver but the patient is hospitalized for a neck injury.

Who Pays?

- Medical follows the person in Auto claims. So the injuries would be covered by the patient’s personal auto insurance (If he or she has one), then health insurance or Medicare.

- If the patient sues the employee/caregiver the personal auto limits on the caregiver’s policy would apply to any damages paid. If those limits are not high enough, and if the Employer is sued, the remaining damages would be covered under Hired and Non-Owned Auto Coverage.

Are Employees Covered Personally?

Under most Hired and Non-Owned Coverage, NO.

How can you cover the employee?

- Add Employees as Insureds Endorsement and then the Hired and Non-owned Auto will cover the employees personally.

Save Driving Policies and Training

Safe Driving Videos: Should be part of employee orientation process

Safe Driving Company Policy: Should be signed by the employee and retained in the employee’s file, and a copy provided for the employee to keep in his/her vehicle.

Reporting Procedures: Develop and enforce a policy requiring the employee to notify policy and promptly inform the employer of any accident.